UPDATED 6:45 am ET

STOCKS – An eight-day losing streak in European stocks ended today as optimism that central bankers around the world will continue to support economic recovery helped the Stoxx Europe 600 Index rebound from a two-week low. U.S. index futures were little changed, while Asian shares rose.

BONDS – Banks are cutting their bund-yield forecasts at a record pace as they bet the European Central Bank’s latest stimulus program will be expanded to buying the sovereign debt of member states.

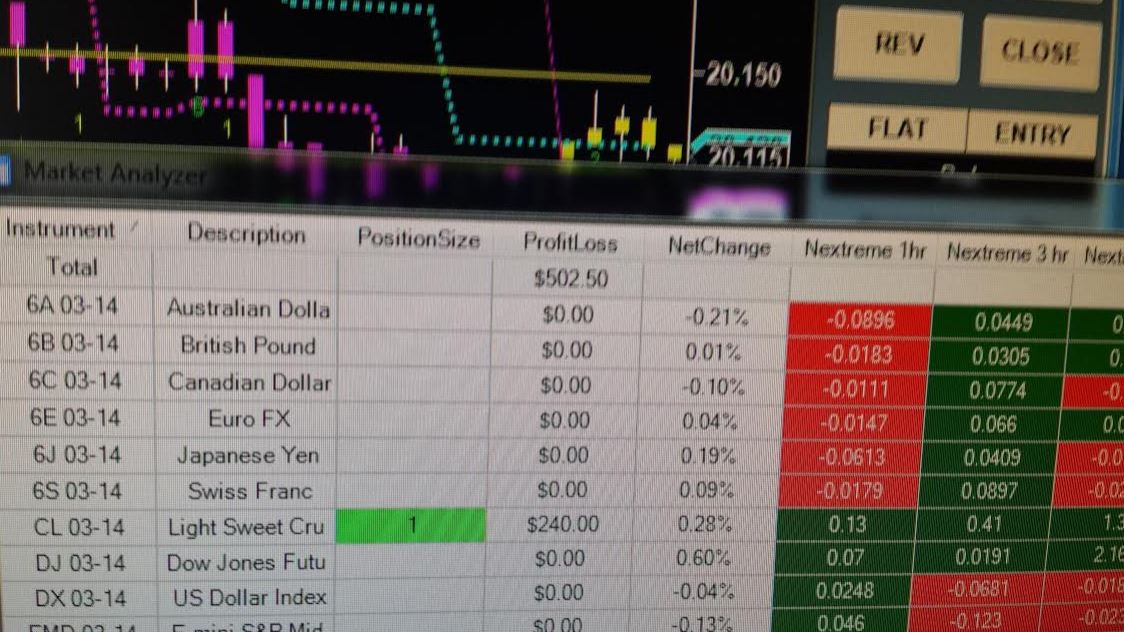

COMMODITIES – West Texas Intermediate traded near the highest price in almost two weeks after OPEC’s secretary general said the group may cut crude-output targets next year.

CURRENCIES – The dollar rose versus the Australian dollar as traders weighed whether the Federal Open Market Committee will alter the language of its policy statement today to signal when interest rates will rise.

ECONOMIC DATA – USD CPI m/m due at 8:30, NAHB Housing Market Index at 10:00, Crude Oil Inventories at 10:30, FOMC Economic Projections and FOMC Statement at 14:00, FOMC Press Conference at 14:30, NZD GDP q/q at 18:45 ET.