Volatility in the Bond market continues.

Don’t trade alone, join a group of quant traders in a live trading room.

The Trading Room® TradeLAB live sessions conducted online by the RiosQuant team offer a pragmatic, real world perspective of trading the global markets in real time for the active trader. Trading begins at 7:30 am and ends at 10:30 am ET Monday thruFriday.

Access is simple, here is how to get started with a two week free trial…

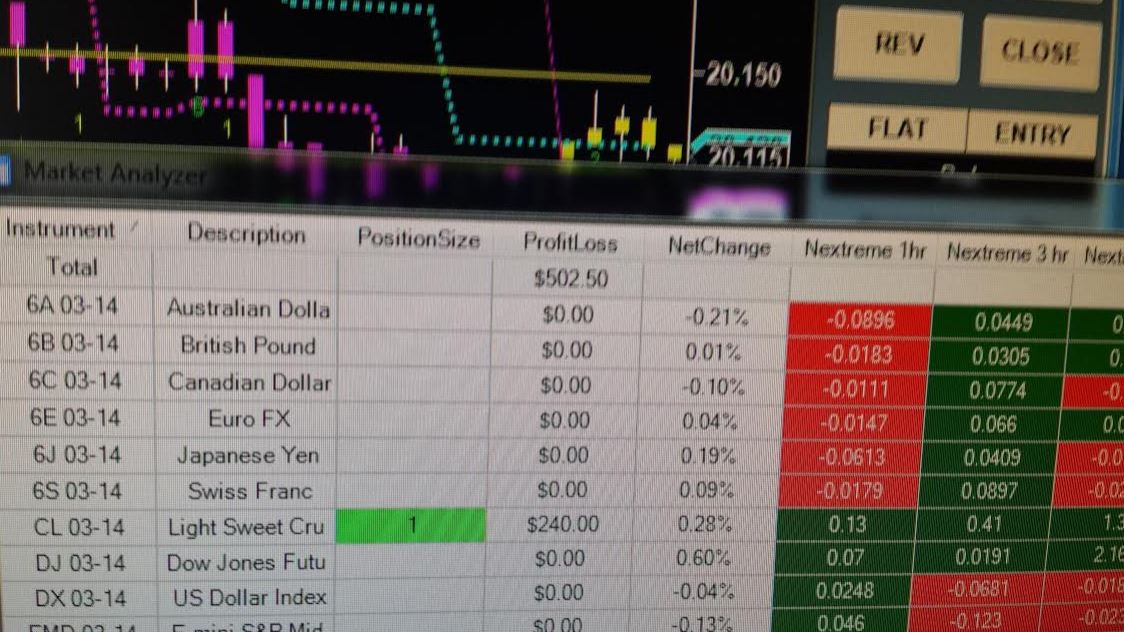

Step 2: You’ll instantly have access to our live trading room, videos, user guides and quantitative rankings covering multiple asset classes including the financials, metals, energies, grains and forex.

Step 3: To access The Trading Room® TradeLAB simply click on the gotowebinar link under The Trading Room. Once you register on the gotowebinar link you will receive daily access links directly from gotowebinar. The link is good for one week, you will need to repeat the process for your second week on the following Monday. Pre-market analysis and live trading begins Monday thru Friday from 7:30 am to 10:30 am ET.

It’s really that simple!

Pre-market activity and scheduled economic data that may have an impact on the global financial markets:

STOCKS – The Shanghai Composite Index gained 0.8 percent at the close, erasing losses after it plunged as much as 5.4 percent. European shares fell to their lowest level in almost a month as a spike in bond yields cast a shadow on borrowing costs. Emerging-market stocks fell for a ninth day, with the index poised for its longest losing streak in almost three months. US stock futures pointing to a lower Wall Street open.

BONDS – European Central Bank president Mario Draghi said wild price swings won’t alter ECB policy sending German 10-year bond yields to an eight-month high, as the rout in the global debt market gathered pace.

COMMODITIES – Crude oil struggled after sliding overnight on concerns generated by a big build-up in distillates and with OPEC expected to reject output cuts at its meeting on Friday.

CURRENCIES – Traders watched the euro rally to a five-month high as the US dollar lost its overnight swagger. That took the euro’s surge over the last two days past 3 percent.

ECONOMIC DATA – US Unemployment Claims due at 8:30, CAD Ivey PMI at 10:00, Natural Gas Storage at 10:30 ET.

– RiosQuant Team