Pre-market trading activity and scheduled economic data that may have an impact on the global financial markets.

WORLD HEADLINES – European stocks and U.S. equity-index futures advanced as investors awaited a batch of economic data for clues on the strength of the world’s biggest economy and the trajectory of interest rates before next week’s Federal Reserve meeting.

STOCKS – Futures on the S&P 500 Index gained 0.3 percent after the underlying benchmark retreated 0.1 percent on Wednesday.

BONDS – The yield on U.S. Treasuries due in a decade rose one basis point to 1.71 percent, after falling three basis points the previous day.

COMMODITIES – Crude oil traded higher following a two-day slide of almost 6 percent. Libya and Nigeria, two OPEC members whose supplies have been crushed by domestic conflicts, are preparing to add hundreds of thousands of barrels to world markets within weeks.

CURRENCIES – The New Zealand dollar led declines with a 0.3 percent drop, after second-quarter gross domestic product increased less than economists predicted.

ECONOMIC DATA – GBP Monetary Policy Summary due at 7:00, US Core Retail Sales m/m, PPI and Philly Fed Manufacturing Index at 8:30, Industrial Production m/m at 9:15 ET.

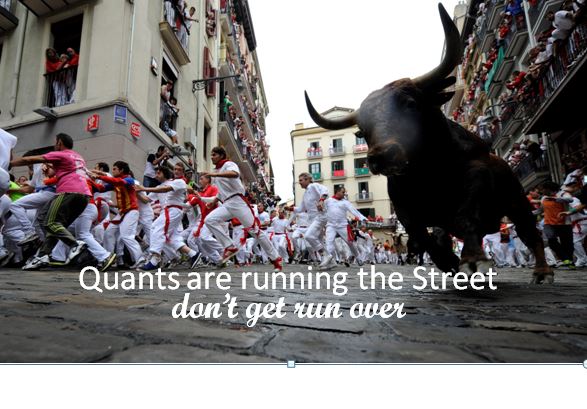

Don’t trade alone, join a group of quant traders in a live trading room.

The Trading Room® TradeLAB live sessions conducted online by the RiosQuant team offer a pragmatic, real world perspective of trading the global markets in real time for the active trader. Trading begins at 8:00 am and ends at 11:00 am ET Monday thruFriday.

Access is simple, here is how to get started with a two week free trial…

Click on the following link and register as a guest.