Don’t trade alone, join a group of quant traders in a live trading room.

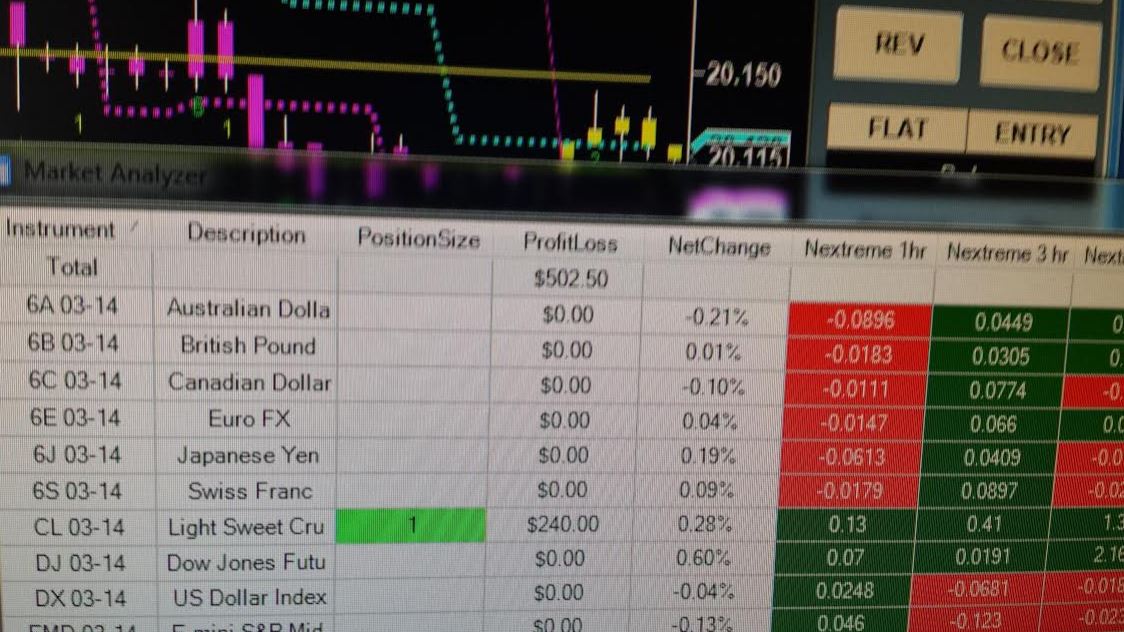

The Trading Room® TradeLAB live sessions conducted online by the RiosQuant team offer a pragmatic, real world perspective of trading the global markets in real time for the active trader. Trading begins at 8:00 am and ends at 11:00 am ET Monday thru Friday.

We are now show casing the new and improved Einstein III automated trading system.

Access is simple, Click on the following link and register as a guest for access.

Pre-market price action and scheduled economic data that may have an impact on the global financial markets:

BONDS – Treasuries gained, with the yield on 10-year notes falling three basis points to 1.73 percent. The rate on similar-maturity German bunds dropped two basis points to 0.10 percent.

COMMODITIES – Gold for immediate delivery pushed higher, following Wednesday’s 0.7 percent retreat. Copper for delivery in three months declined with industrial metals on the London Metal Exchange.

CURRENCIES – The yen surged toward 108 per dollar to the strongest level in 1 1/2 years as the Bank of Japan’s apparent reluctance to intervene kept investors buying.

ECONOMIC DATA – EUR ECB Monetary Policy Meeting Accounts due at 7:30, US Unemployment Claims and CAD Building Permits at 8:30, ECB President Draghi Speaks at 10:00, Natural Gas at 10:30, Fed Chair Yellen speaks at 5:30 ET.

– Trading Team, Rios Quantitative LLC

THERE IS A SUBSTANTIAL RISK OF LOSS IN TRADING COMMODITY FUTURES, OPTIONS, AND FOREIGN EXCHANGE PRODUCTS