Pre-market trading activity and scheduled economic data that may have an impact on the global financial markets.

WORLD HEADLINES – European stocks and bonds fell in a volatile market on Monday, hit by growing concerns that global central banks’ commitment to the post-crisis orthodoxy of super-low interest rates and asset purchase programs may be waning.

STOCKS – S&P 500 Index futures slipped 0.6 percent, indicating U.S. equities will slide for a fourth day, after ending last week lower.

BONDS – Some Fed members have been talking up the September meeting as being “live” for a rate hike, even though futures only imply a one-in-four chance of a move then.

COMMODITIES – Oil prices extended Friday’s 4 percent fall in Asia after reports showed increasing drilling activity in the United States, indicating that producers can operate profitably around current levels and bring on new supply.

CURRENCIES – In the forex market, the risk aversion benefited perceived safe havens such as the yen while hitting carry trades in higher yielding currencies including the Australian dollar.

ECONOMIC DATA – FOMC Member Brainard Speaks at 13:00, 10-y Bond Auction at 13:01, RBA Assist Gov Kent Speaks at 18:30, CNY Industrial Production y/y at 22:00 ET.

Don’t trade alone, join a group of quant traders in a live trading room.

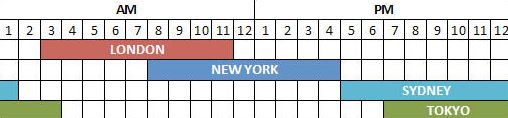

The Trading Room® TradeLAB live sessions conducted online by the RiosQuant team offer a pragmatic, real world perspective of trading the global markets in real time for the active trader. Trading begins at 8:00 am and ends at 11:00 am ET Monday thruFriday.

Access is simple, here is how to get started with a two week free trial…

Click on the following link and register as a guest.