From the desk of Joe Rios

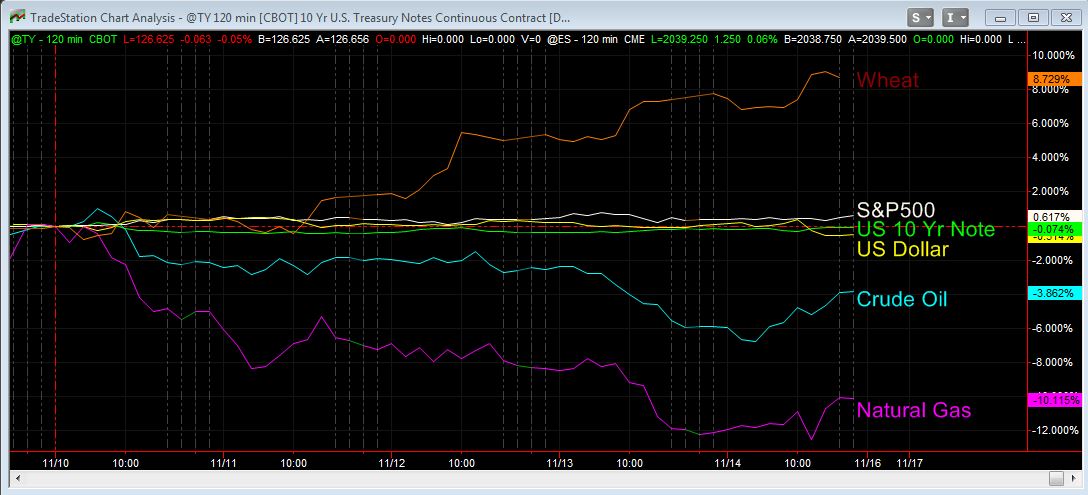

As expected the major benchmarks traded in a tight range for most of last week. The S&P 500 inched higher 0.6% while the US Treasury 10 Year Note and the US Dollar ended the week where it started with no change 0.0%. The absence of key economic data and a tight trading range helped to create a mixed and conflict market sentiment readings, more than in the previous weeks.

However the Commodities did provide trading opportunities with Wheat gaining 8.7% and Corn 3.9%. Shorting opportunities were also present with Natural Gas dropping -10.1% and Crude Oil -3.8%. In the week ahead the economic calendar should provide more opportunities with US inflation data, Fed news and potential market moving data, statement and speeches from Asia and Europe. I will be looking for a breakdown or breakout from last week’s trading range in the major benchmarks for trade set ups. I will also focus in the commodity sector for trading opportunities including the Grain, Energy and Metal markets. I will also pay attention to the correlation between the US Treasury 10 Year Note, Gold and Foreign Currencies.

Joe Rios

Chief Strategist, Rios Quantitative LLC

Relative performance from Monday the 10th to Friday November 14th 2014.

Live Trading Rooms and Events: The Trading Room TradeLAB

Global Trading with Quantitative Technologies

https://www3.gotomeeting.com/register/336491422

Monday through Friday beginning at 7:30 AM ET

RQ trade coaches include Edward Preston, Steve Schwartz and Joe Rios. Live demonstration of our pre-market quantitative analysis, real-time trading signals with RQ algorithmic technology, strategy performance review and Q&A session.

Insider’s Quant (IQ) Room – Advanced Concepts with Joe Rios

Monday, Tuesday and Thursday beginning at 1:30 PM ET

SUBSCRIPTION ONLY – REQUEST FREE TRIAL HERE:

https://www.thetradingroom.com/algorithmic-trading/

_______________________________________________

The Trading Room EDU – Educational Workshop – Covering the RiosQuant Trading Indicators:

Wednesday beginning at 1:30 PM ET

https://www3.gotomeeting.com/register/382377966

Topic: The Next Big Swing

Presenter: Steve Schwartz

Saturday beginning at 11:00 AM ET

https://www3.gotomeeting.com/register/399144542

Topic: RiosQuant Basic

Presenter: Steve Schwartz

Monday

9:00 AM EUR ECB president Draghi speaks

7:30 PM AUD Monetary Policy Meeting Minutes

Tuesday

3:25 AM AUD RBA Gov. Stevens speaks

4:30 AM GBP CPI

5:00 AM EUR German ZEW Economic Sentiment

8:30 AM USD PPI

Tentative JPY Monetary Policy Statement and BOJ Press Conference

Wednesday

4:30 AM GBP MPC Official Bank Rate Votes

8:30 AM USD Building Permits

10:30 AM Crude Oil Inventories

2:00 PM USD FOMC Meeting Minutes

8:45 PM CNY HSBC Flash Manufacturing PMI

Thursday

3:00 AM EUR French Flash Manufacturing PMI

3:30 AM EUR German Flash Manufacturing PMI

4:30 AM GBP Retail Sales

8:30 AM USD Core CPI and Unemployment Claims

8:30 AM CAD Wholesale Sales

10:00 AM USD Philly Fed Manufacturing Index

10:30 AM Natural Gas Storage

Friday

3:00 AM EUR ECB President Draghi speaks

8:30 AM CAD Core CPI