From the Desk of Joe Rios

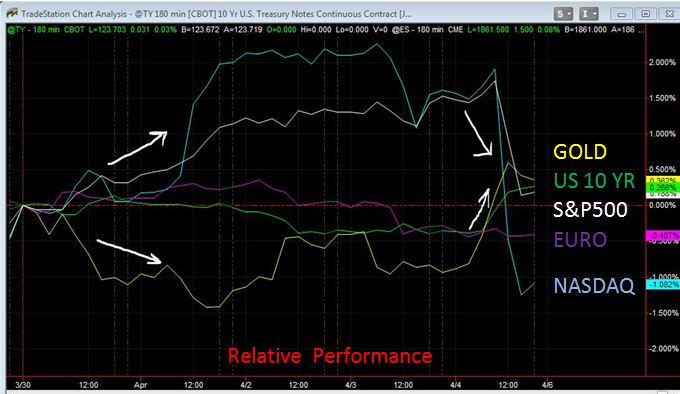

The stock indices were in the limelight as the Dow and S&P 500 reached record highs intra week, while the NASDAQ continued to underperform. All of the stock indices sold off sharply Friday into the close led by NASDAQ momentum stocks. As for the broader market, the recent record high was a struggle, as the last two days saw intra-day new highs but stocks ended closing near the lows.

In the week ahead I will pay close attention to price action in the S&P 500 and the correlations within the NASDAQ, US Ten Yr Note, Euro and Gold. I will also focus on momentum style of trading over trend following for potential trading opportunities.

Joe Rios

Chief Market Strategist

www.riosquant.com

Live Rooms and Events

Please take note of this week’s schedule at a glance including key economic reports that might have an impact on the markets. Live trading rooms and educational events are also listed with the appropriate links for gaining access. While some of the events are free, others are for members only. Let us know if you have an interest and we will provide you with all the pertinent information.

Contact Information for your Support Needs:

Amber Little, RQ Client Relations Manager

email: amber@riosquant.com

skype: alittlemobile

cellphone: 415.336.7272

Live Trading Rooms and Events:

The Trading Room TradeLAB

Global Trading with Quantitative Technologies

Monday through Friday beginning at 7:30 AM ET

https://www3.gotomeeting.com/register/916949446

RQ trade coaches include Edward Preston, Steve Schwartz and Joe Rios. Live demonstration of our pre-market quantitative analysis, real-time trading signals with RQ algorithmic technology, strategy performance review and Q&A session.

Insider’s Quant (IQ) Room – Advanced Concepts with Joe Rios

Wednesday and Thursday beginning at 1:30 PM ET

Subscription Only!

_______________________________________________

The Trading Room EDU – Educational Workshop

Covering the Rios Quant Trading Indicators:

Wednesday beginning at 7:30 PM ET

https://www3.gotomeeting.com/register/822485750

Topic: Rios Quant Basics with Steve Schwartz

Thursday beginning at 7:30 PM ET

https://www3.gotomeeting.com/register/183169342

Topic: 90 Day Trading Program – part 1 of 12 with Edward Preston

Saturday beginning at 10:30 AM ET

https://www3.gotomeeting.com/register/249298086

Topic: Rios Quant Basics with Steve Schwartz

MONDAY

Economic Data Release – Market Movers

NZD – NZIER Business Confidence – 6:00 PM ET

AUD – NAB Business Confidence – 9:30 PM ET

JPY – Monetary Policy Statement – Tentative

TUESDAY

Economic Data Release – Market Movers

JPY – BOJ Press Conference – Tentative

GBP – Manufacturing Production – 4:30 AM ET

CAD – Building Permits – 8:30 AM ET

USD – Jolts Job Openings – 10:00 AM ET

USD – FOMC Member Kocherlakota Speaks – 1:30 PM ET

WEDNESDAY

Economic Data Release – Market Movers

USD – Crude Oil Inventories – 10:30 AM ET

USD – 10 YR Note Auction – 1:01 PM ET

USD – FOMC Meeting Minutes – 2:00 PM ET

AUD – Employment Change – 9:30 PM ET

THURSDAY

Economic Data Release – Market Movers

CNY – Trade Balance – Tentative

GBP – Official Bank Rate – 7:00 AM ET

USD – Unemployment Claims – 8:30 AM ET

G 20 Meetings – All Day

USD – Natural Gas Storage – 10:30 AM ET

CNY – CPI – 9:30 PM ET

FRIDAY

Economic Data Release – Market Movers

USD – PPI – 8:30 AM ET

USD – Preliminary Uom Consumer Sentiment – 9:55 AM ET

G 20 Meetings – All Day

THERE IS A SUBSTANTIAL RISK OF LOSS IN TRADING COMMODITY

FUTURES, OPTIONS, AND FOREIGN EXCHANGE PRODUCTS