The iNewton™ Quantitative System P7 Program

Uniquely Designed and Built

The iNewton™ strategy is a quantitative trading system uniquely designed and built to exploit short term opportunities. The unique logic that drive the algorithms of iNewton™ make it the ideal strategy to trade the current Trump era markets. The computer driven model identifies intermarket correlations to pin-point institutional behavior including the risk-on risk-off trade, the crowded-trade effect and the carry-trade.

To request more information including minimum account size and investor qualification please click here.

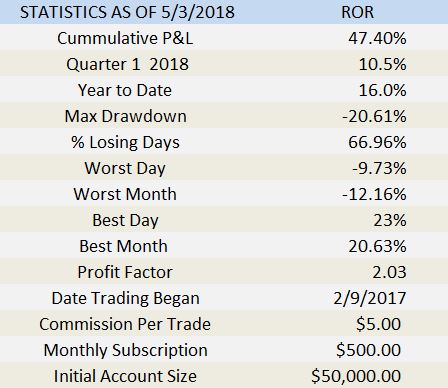

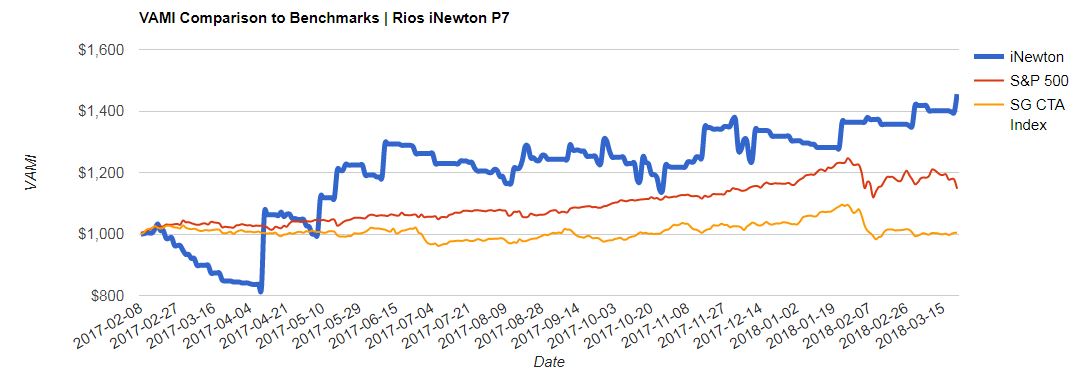

The following performance summary stats are for the iNewton™ P7 letter of direction accounts as of May 3, 2018.

To request more information please click here.

Joe Rios is the founder of Rios Quantitative LLC, he is a 29-year Wall Street insider, recognized worldwide as an innovator, and developer of trading strategies and automated trading systems. He has received several industry awards and recognition from large financial institutions including Franklin Templeton Group and Oppenheimer Funds. He is also the president and chief portfolio manager for Advanz Analytics, Inc., a Commodity Trading Advisor (CTA) registered with the US Commodity Futures Trading Commission (CFTC).

Important information about the trading system performance analysis: Unless otherwise specified the tables and charts represent the summation of actual trades based on system-specified orders executed or recorded through BTR Trading Group, Inc. for the stated time period. Performance statistics referenced herein represent a model tracking account. This tracking account rises or falls based on the average per trading unit profit and loss achieved by actual clients trading this system. Profits are not reinvested and all rates of return are ‘simple returns‘. Actual dollar and percentage gains/losses experienced by investors would depend on many factors not accounted for in these statistics, including, but not limited to, starting account balances, market behavior, developer fees, incidence of split fills and other variations in order execution, and the duration and extent of individual investor participation in the specified system. THE RISK OF LOSS IN TRADING COMMODITY FUTURES AND OPTIONS CAN BE SUBSTANTIAL AND MAY NOT BE SUITABLE FOR ALL INVESTORS. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. CLICK HERE FOR FULL RISK DISCLOSURE.