This past week the IMF released the World Economic Outlook report with downward revisions to global growth. The equity markets traded lower three out of the five trading sessions. Risk of volatility continues to be on the down side. US Treasury Notes and Bonds continued to test key RQ-Channel resistance levels. Natural Gas impressively broke out of the key RQ-Channel resistance following the release of storage data, closing the week as the outperforming asset class with 4% gains and maintaining its bullish RQ 4 ranking. Gold had its largest one-day drop in its history but managed to find new support level as outlined in the RQ-Channel. In the week ahead I will be paying close attention to the currency markets. The British pound may be volatile as we approach GDP data, potentially making history with a triple dip recession. Economic data from Europe should also help trigger volatile price action.

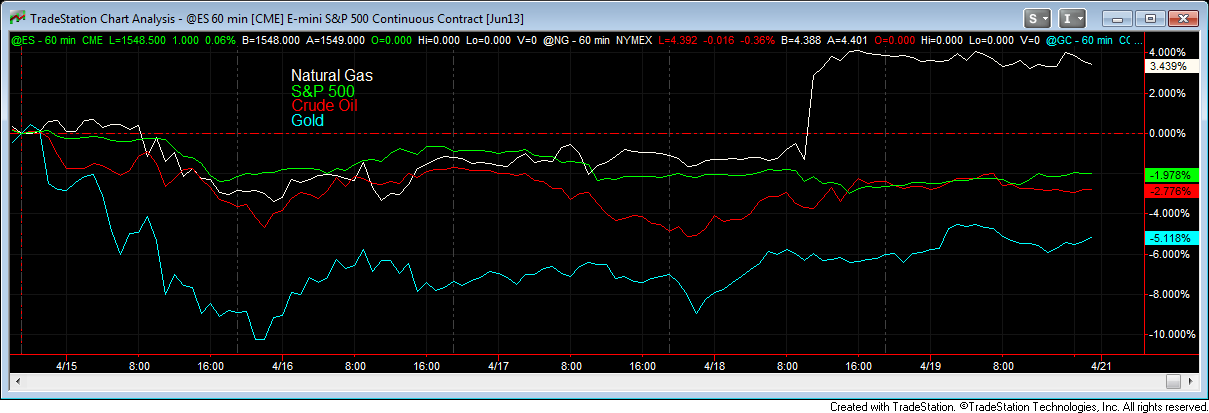

Relative Performance for week ending April 19, 2013 – Natural Gas, S&P 500, Crude Oil and Gold.

Join us in this week’s TradeLAB and watch our head quant trader Edward Preston trade the global markets with the RiosQuant trading system. Click on the following link to receive your access pass http://www.riosquant.com/events/events_list/all