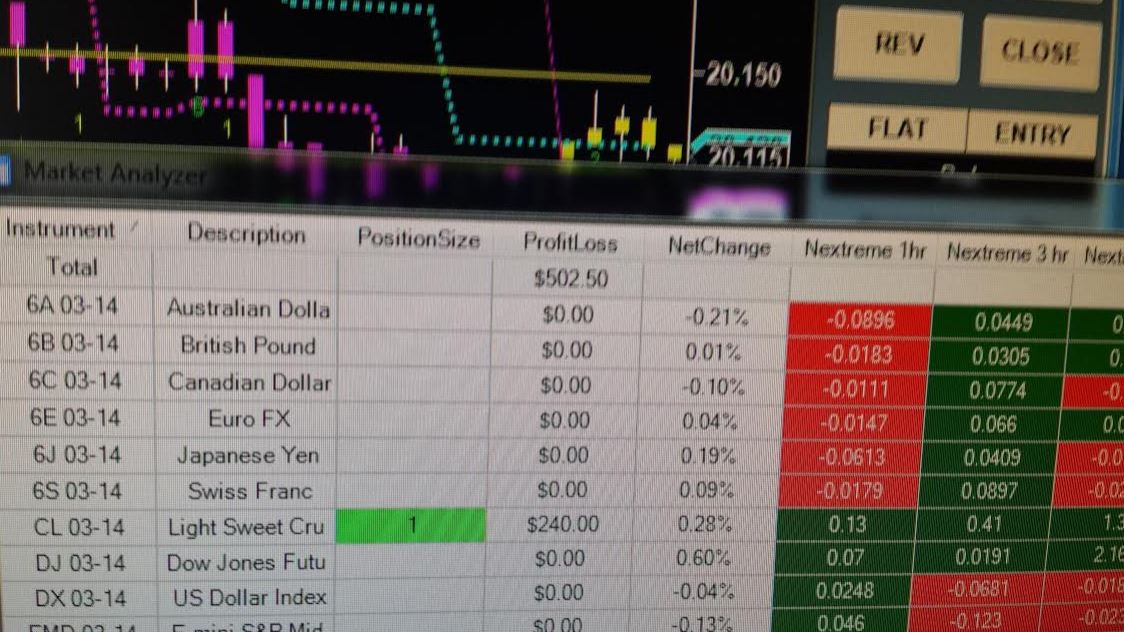

Pre-market trading activity and scheduled economic data that may have an impact on the global financial markets.

WORLD HEADLINES – The U.S. dollar sank to its weakest level since June before key economic data reports that may add to signs growth in the world’s largest economy is losing momentum. The slide was felt across the globe, from emerging markets to commodities.

STOCKS – Emerging markets have soared 33 percent from a January low, driving valuations to the highest level in 15 months.

BONDS – The yield on U.S. Treasuries due in a decade fell three basis points to 1.53 percent. Rates on similar-maturity debt in Germany and Japan decreased by about one basis point to minus 0.08 percent and minus 0.10 percent, respectively.

COMMODITIES – Gold advanced 0.9 percent amid a decline in the dollar. Silver and platinum both added more than 1 percent.

CURRENCIES – The U.S. dollar fell as recent weak U.S. economic data was seen limiting the prospects for a near-term interest-rate rise.

ECONOMIC DATA – CAD Manufacturing Sales, US Building Permits, CPI and Housing Starts all due at 8:30, Industrial Production m/m at 9:15, NZD Employment Change and PPI at 18:45 ET.

Don’t trade alone, join a group of quant traders in a live trading room.

The Trading Room® TradeLAB live sessions conducted online by the RiosQuant team offer a pragmatic, real world perspective of trading the global markets in real time for the active trader. Trading begins at 8:00 am and ends at 11:00 am ET Monday thruFriday.

Access is simple, here is how to get started with a two week free trial…

Click on the following link and register as a guest.