Forecasting price movement in the financial markets is at the forefront for all market participants, regardless of investment style or trading methodology. Having a good understanding of how the global financial markets really work can provide the investor and active trader with an edge in the markets. The study of intermarket relationships among the major asset classes along with correlation analysis, often provides predictive values. Knowing when institutional investors begin to build positions during the early stages of a major shift in market sentiment can provide the active trader with opportunities. Below are some excerpts from recent research notes provided to the RiosQuant members that participate in our Insider’s Quant Room sessions.

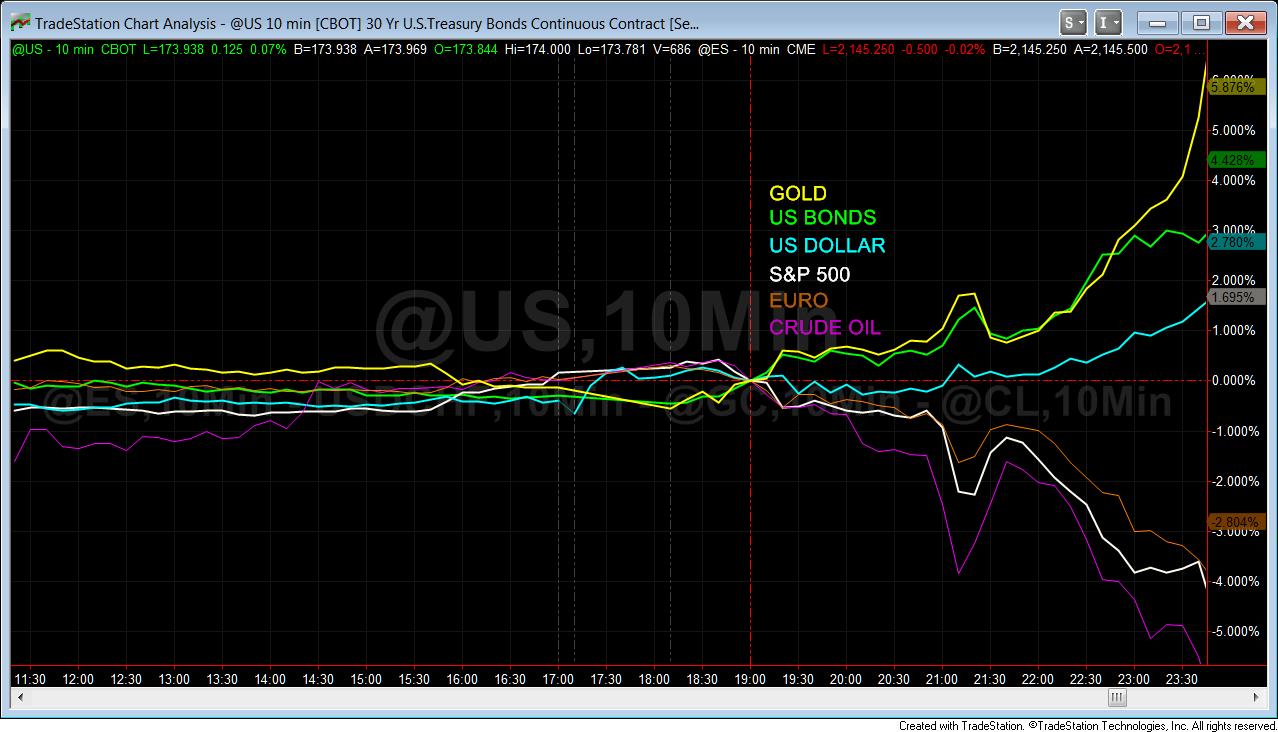

On June 20, 2016 during our Monday session of the Insiders Quant Room, I discussed a couple possible outcomes regarding UK’s referendum vote to leave the European Union scheduled for June 23, 2016. As customary for our preparation for the week ahead, in the Bar Room Napkin notes, I wrote the following:

“If no Brexit, possible Fed hike

US Dollar weakness & Bond weakness

If Brexit, safe haven flows

Gold, Bonds, US Dollar strengthen”

– June 20, 2016

Chart above illustrates market reaction following UK referendum vote.

During the next meetup, on June 27, 2016 following UK’s referendum vote to leave the European Union, I discussed the potential of a new shift of capital inflows to US assets including the dollar, bonds, stocks and real estate. I also mentioned rotation from risk-on to risk-off sentiment and then a flight to quality assets. Consistent with our preparation for the week ahead, in the Bar Room Napkin notes, I wrote the following:

“Risk assets vs. Safe havens vs. Flight to quality”

– June 27, 2016

Since then we have seen the S&P 500 and Dow Jones industrial average trade at record highs, erasing the losses triggered by the UK’s vote to leave the European Union. Inflows have also seen the safety of treasuries in the aftermath of the Brexit, sending bond yields to record lows last week. Fresh highs for stocks with all time lows for bond yields is unusual given that they are generally seen as risk-on and risk-off compliments. Demand for US bonds has also ramped up amid subzero yields in Europe and Japan. I expect this trend to continue however I do anticipate we will have days or series of trading sessions with correlations shifting to risk-on risk-off sentiment. It will be during these shifts (to and from) that should provide optimal timing for trading opportunities.

It seems like I am not the only one forecasting for a flight to quality. According to a Bloomberg article published today July 7, the chairman of O’Shares Investments and Shark Tank personality has filed a prospectus with the Securities and Exchange Commission to launch 17 ETFs. All the proposed offerings have “quality” in the name and would employ a passive investing approach.

Joe Rios

Rios Quantitative LLC

joegrios@riosquant.com

COMMODITY FUTURES, OPTIONS, AND FOREX TRADING INVOLVES SUBSTANTIAL RISK AND IS NOT SUITABLE FOR ALL INVESTORS. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.