From the desk of Joe Rios

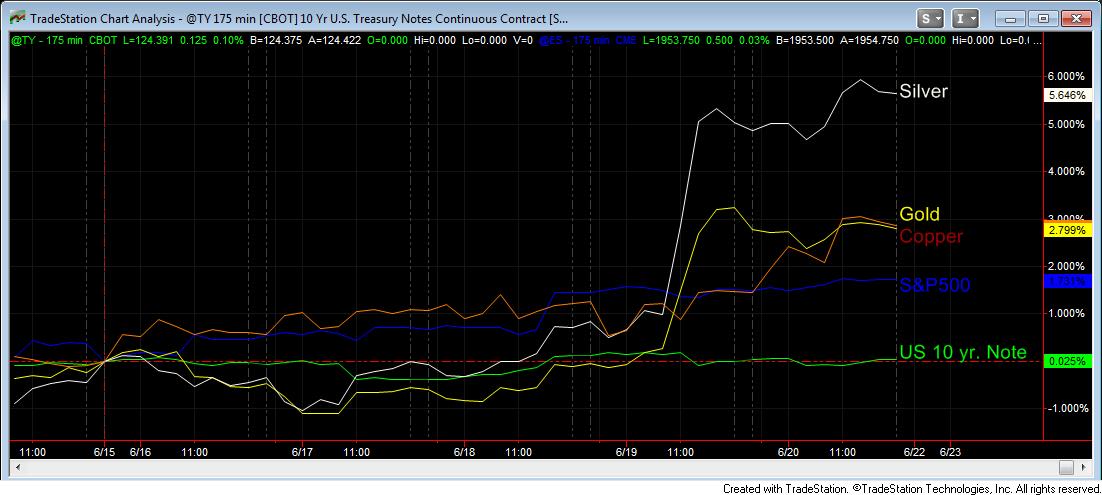

The FOMC event this past week was the main focus for traders and investors alike. As expected the markets accelerated during Yellen’s press briefing with risk assets trading higher. However it was the Metals with Silver and Gold’s bullish price action on Thursday that stole the show. What was the message from that move? Is inflation back at the forefront? Inflation is already above the 2% target. Is the Fed behind the curve? In the week ahead I expect the focus will turn to the Fed and therefore to economic data releases. I will place close attention to the reaction and sensitivity from price action to the data releases. I will keep track of rotation flows from the major asset classes including the S&P 500, US Treasury 10 Year Note and the US Dollar. It should be a good week for events trading as I expect traders to react swiftly from any surprises. News from the Iraqi conflict can also bring volatility to the financial markets

Joe Rios

Founder – Rios Quantitative LLC

Relative Performance – Silver, Gold, Copper, S&P 500 and US 10 Yr. Note – Week ending June 20th, 2014

Please take note of this week’s schedule at a glance including key economic reports that might have an impact on the markets. Live trading rooms and educational events are also listed with the appropriate links for gaining access. While some of the events are free, others are for members only. Let us know if you have an interest and we will provide you with all the pertinent information.

Amber Little, RQ Client Relations Manager

email: amber@riosquant.com

skype: alittlemobile

cellphone: 415.336.7272

![]() Live Trading Rooms and Events:

Live Trading Rooms and Events:

The Trading Room TradeLAB – Global Trading with Quantitative Technologies

https://www3.gotomeeting.com/register/194846974

Monday through Friday beginning at 7:30 AM ET

RQ trade coaches include Edward Preston, Steve Schwartz and Joe Rios. Live demonstration of our pre-market quantitative analysis, real-time trading signals with RQ algorithmic technology, strategy performance review and Q&A session.

_______________________________________________

Insider’s Quant (IQ) Room – Advanced Concepts with Joe Rios

Monday, Wednesday and Thursday beginning at 1:30pm ET

Subscription Only!

_______________________________________________

The Trading Room EDU – Educational Workshop – Rios Quant Trading Indicators:

Wednesday beginning at 1:00 PM ET

https://www3.gotomeeting.com/register/575711926

Topic: Momentum Trading Crude Oil and E-mini Stock Futures

Presenter: Steve Schwartz

Wednesday beginning at 7:30 PM ET

https://www3.gotomeeting.com/register/578067430

Topic: The Next Big Swing

Presenter: Edward Preston

Thursday beginning at 7:30 PM ET

The RiosQuant 90 Day Training Program – Online Workshop

https://www3.gotomeeting.com/register/556611966

Training Session 12 of 12 with Steve Schwartz

Topic: 5 Rules of Engagement

Saturday beginning at 11:00 AM ET

https://www3.gotomeeting.com/register/566357334

Topic: Week in Review with Gnostick Levels

Presenter: Steve Schwartz

_______________________________________________

Monday

2:00 AM JPY BOJ Gov Kuroda Speaks

3:00 AM EUR French Flash Manufacturing PMI

3:30 AM EUR German Flash Manufacturing PMI

10:00 AM USD Existing Home Sales

Tuesday

4:00 AM EUR German IFO business climate

4:30 AM GBP BOE Gov. Carney speaks

10:00 AM USD CB consumer confidence and new-home sales

Wednesday

8:30 AM USD core durable goods orders and final GDP

10:30 AM crude oil inventories

Thursday

5:30 AM GBP BOE Gov. Carney speaks

8:30 AM USD unemployment claims and personal spending

10:30 AM natural gas storage

6:45 PM NZD trade balance

7:30 PM JPY household spending

Friday

all day EUR German preliminary CPI

4:30 AM GBP current account