From the desk of Joe Rios

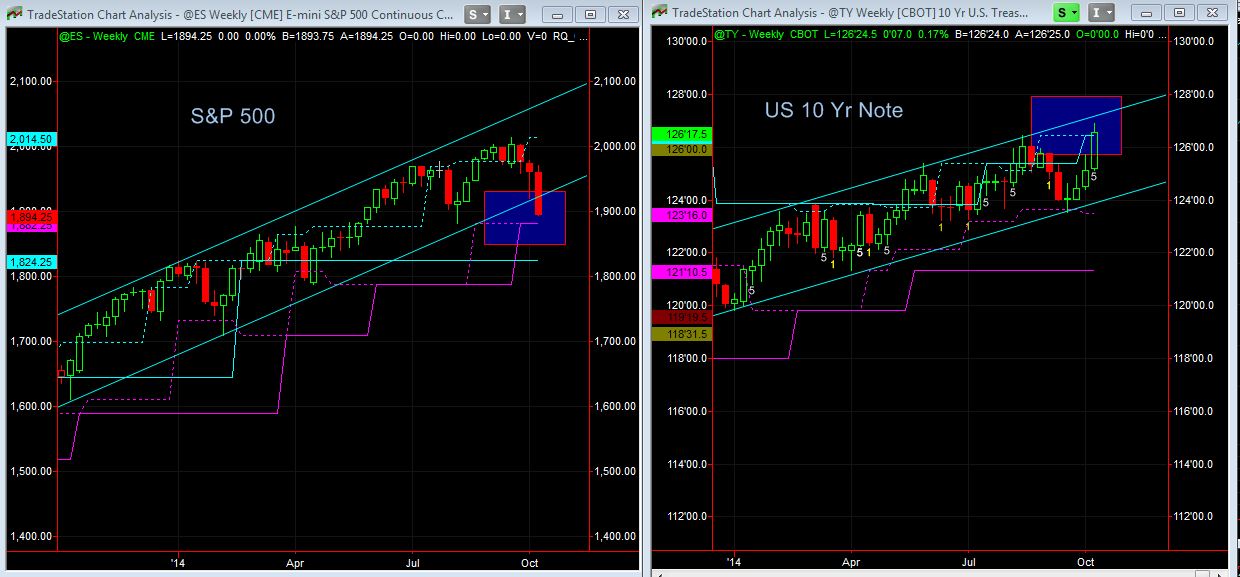

Volatility hit the risk assets with the Russell 2000 sliding -4.8% followed by Crude Oil -4.7%. Risk OFF sentiment dominated most of the week with the US 30 Yr Bond rising 1.8% while the S&P 500 dropped -3.4%. Other markets reacted as the Japanese Yen rallied 2.1% as carry trades began to unwind. Gold and Silver also rose along with the US Treasuries as correlations continued throughout most of the week. In the Forex market most of the major currencies consolidated with the US Dollar slipping -1%. Earnings season kicks off this week taking center stage for most traders and investors alike. I will pay special attention to how the markets react to corporate guidance as well as company earnings. My focus will remain on the US 10 Yr Note futures as a leading indicator for the direction of risk asset s. Correlations have been tight between the benchmarks providing cue to market behavior, therefore I will continue until the market dynamics change. Take special note of the illustration below with the two main benchmarks. The S&P 500 broke from the long term bullish channel and is close to testing the RQ Channel low 2 and 7 indicators. Will this week’s corporate earnings or an upbeat earnings outlook help prices bounce? Or will a weak earnings outlook push prices through the RQ Channel’s key level? Conversely, the US 10 Yr Note closed the week at the RQ Channel high 2 and 7 level. Will the US 10 Yr Note consolidate at this key level or push higher? Or will it be economic data from China to trigger the next move?

Joe Rios – Chief Market Strategist

Weekly chart of the S&P 500 and 10 Yr Note futures.

Live Trading Rooms and Events:

The Trading Room TradeLAB – Global Trading with Quantitative Technologies

https://www3.gotomeeting.com/register/932890598

Monday through Friday beginning at 7:30 AM ET

RQ trade coaches include Edward Preston, Steve Schwartz and Joe Rios. Live demonstration of our pre-market quantitative analysis, real-time trading signals with RQ algorithmic technology, strategy performance review and Q&A session.

Insider’s Quant (IQ) Room

Advanced Concepts with Joe Rios

Monday, Tuesday, and Thursday beginning at 1:30 PM ET

SUBSCRIPTION ONLY

_______________________________________________

The Trading Room EDU – Educational Workshop

Covering the RiosQuant Trading Indicators:

Tuesday beginning at 7:30 PM ET

https://www3.gotomeeting.com/register/250645798

RiosQuant Trading Program – Workshop Lesson 1 of 12

Topic: Introduction to Quantitative Trading Strategies and Techniques

RiosQuant Performance Coach Steve Schwartz

Saturday beginning at 11:00 AM ET

https://www3.gotomeeting.com/register/262329462

Topic: The One Indicator for Uncovering Market Dynamics

Presenter: Steve Schwartz

MONDAY

Economic Data Release – Market Movers

CNY – Trade Balance – Tentative

AUD – NAB Business Confidence – 8:30 PM ET

TUESDAY

Economic Data Release – Market Movers

GBP – CPI – 4:30 AM ET

EUR – German ZEW Economic Sentiment – 5:00 AM ET

CNY – CPI – 9:30 PM ET

WEDNESDAY

Economic Data Release – Market Movers

EUR – ECB President Draghi Speaks – 3:00 AM ET

GSP – Average Earnings Index – 4:30 AM ET

USD – Retail Sales – 8:30 AM ET

NZD – GDT Price Index – Tentative

EUR – ECB President Draghi Speaks – 2:00 PM ET

THURSDAY

Economic Data Release – Market Movers

CAD – Manufacturing Sales – 8:30 AM ET

USD – Unemployment Claims – 8:30 AM ET

USD – Philly Fed Manufacturing Index – 10:00 AM ET

FRIDAY

Economic Data Release – Market Movers

USD – Building Permits – 8:30 AM ET

USD – Fed Chair Yellen Speaks – 8:30 AM ET

CAD – Core CPI – 8:30 AM ET

USD – Preliminary Uom Consumer Sentiment – 9:55 AM ET