From the desk of Joe Rios

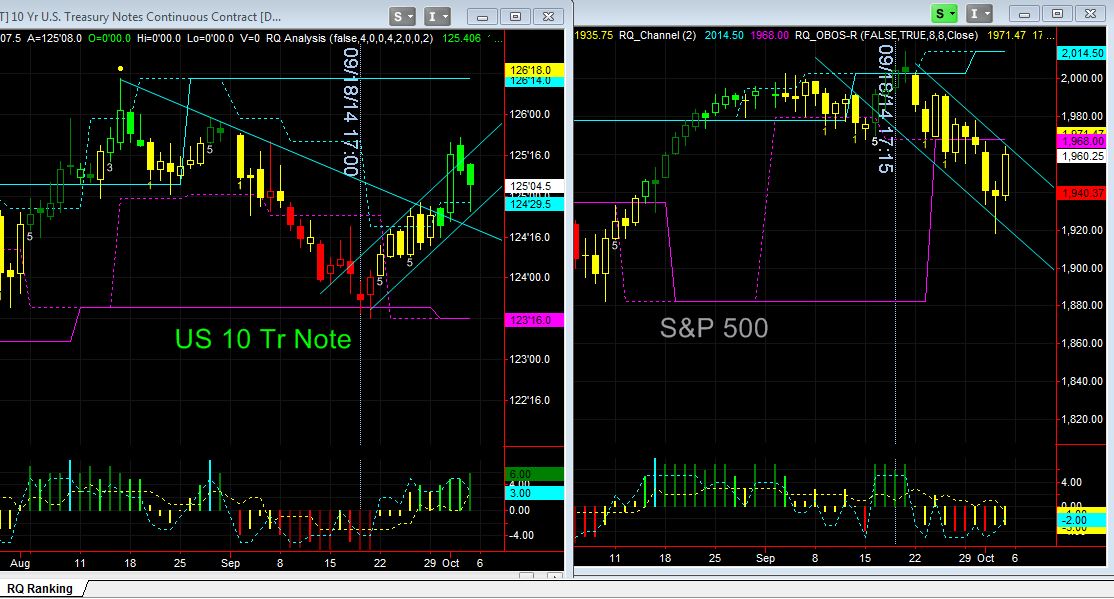

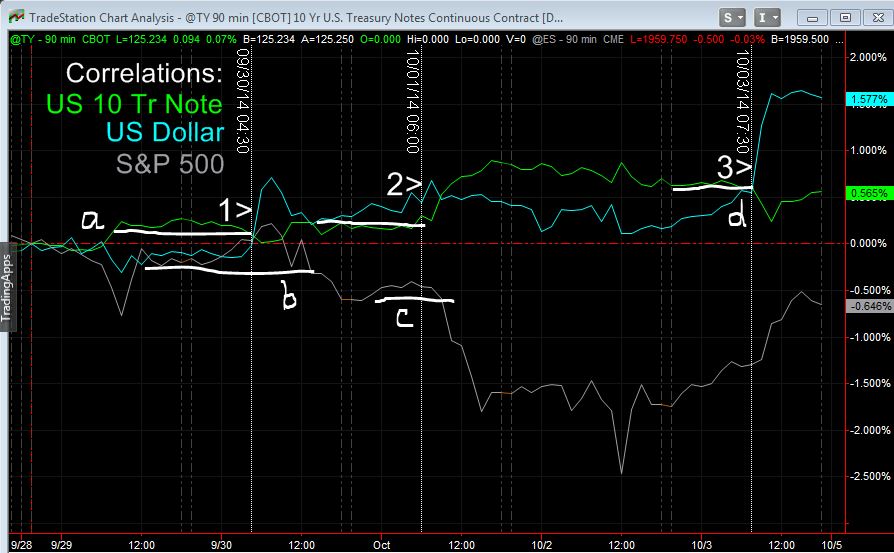

It was an exciting week in the global financial markets with the three main benchmarks continuing to trade in tight correlation mode. As mentioned in last week’s The Week Ahead, the expectation of volatility spiking came true when the US 10 Year Note futures broke out of a symmetric triangle and the S&P 500 broke down from a key support level. The US Dollar consolidated for most of the week, however on Friday the greenback pursued with an impressive bullish breakout following US Non-Farm employment data, continuing its previous trend. It proved prudent to focus on the US 10 Year Note futures as a leading indicator as it traded a step ahead of the other benchmarks for most of the week.

As you can see from the illustrations below the US 10 year note and S&P 500 finished the week at key levels. Can you notice the relationship between the benchmarks? Can you spot which market was the leading indicator? In the week ahead I will continue to focus on the 10 Year Note futures for insights for selecting markets poised for aggressive price action. The independents including Natural Gas and the Grains continued to consolidate. I will be looking for any potential break, to either direction. After the recent consolidation will we see short covering in the Grain market? Or trend continuation? The data calendar is light this week, however there are several speeches that have the potential to spark price action in the risk assets.

Joe Rios – Founder, Rios Quantitative LLC

Live Rooms and Events

The Trading Room TradeLAB

https://www3.gotomeeting.com/

Global Trading with Quantitative Technologies

Monday through Friday

RQ trade coaches include Edward Preston, Steve Schwartz and Joe Rios. Live demonstration of our pre-market quantitative analysis, real-time trading signals with RQ algorithmic technology, strategy performance review and Q&A session.

______________________________

The Trading Room EDU – Educational Workshop

Covering the Rios Quant Trading Indicators:

Wednesday beginning at 1:00 PM ET

https://www3.gotomeeting.com/

Topic: E-Mini Index Futures

Presenter: Steve Schwartz

Saturday beginning at 11:00 AM ET

https://www3.gotomeeting.com/

Topic: Can trading be as simple as support and resistance?

Presenter: Steve Schwartz

Monday

10:00 AM CAD Ivey PMI

5:00 PM NZD NZIER Business Confidence

11:30 PM AUD RBA Rate Statement

Tuesday

Tentative JPY BOJ Press Conference

4:30 AM GBP Manufacturing Production

8:30 AM CAD Building Permits

10:00 AM USD JOLTS Job Openings

1:20 PM USD FOMC Member Kocherlakota Speaks

3:00 PM USD FOMC Member Dudley Speaks

Wednesday

8:15 AM CAD Housing Starts

10:30 AM Crude Oil Inventories

1:01 PM USD 10 Year Bond Auction

2:00 PM USD FOMC Meeting Minutes

8:30 PM AUD Employment Change

Thursday

7:00 AM GBP Official Bank Rate

Tentative GBP MPC Rate Statement

8:30 AM USD Unemployment Claims

10:30 AM Natural Gas Storage

11:00 AM EUR ECB President Draghi Speaks

All Day Day 1 G 20 Meetings

8:45 PM AUD RBA Assistant Gov. Edey Speaks

Friday

8:30 AM CAD Employment Change

All Day Day 1 IMF Meetings

All Day Day 2 G 20 Meetings

THERE IS A SUBSTANTIAL RISK OF LOSS IN TRADING COMMODITY FUTURES, OPTIONS, AND FOREIGN EXCHANGE PRODUCTS. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.